Best 25 Personal Loan Apps in India – Apply Instant Personal Loan Online

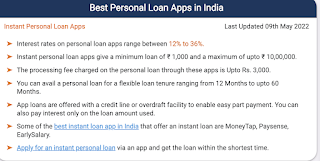

Best Personal Loan Apps in India :

Best Instant Personal Loan Apps in India [2022]

Below is the list of the top 25 best loan apps in India:

- PaySense

- CASHe

- EarlySalary

- Nira

- KreditBee

- Credy

- mPokket

- Dhani

- Bajaj Finserv

- MoneyTap

- FlexSalary

- MoneyView

- PayMe India

- SmartCoin

- StashFin

- HomeCredit

- ZestMoney

- IDFC First Bank

- LoanTap

- Fullerton India

- LazyPay

- IndiaLends

- CashBean

- RupeeLend

- AnyTimeLoan

PaySense

Founded by SayaliKaranjkar and Prashanth Ranganathan, PaySense is an instant money app that offers instant cash loans online. You can use a phone or laptop to check your loan eligibility, submit your KYC details and apply for a loan, receiving approval within 5 hours. The company provides personal loans online of up to ₹ 5 Lakh and you can use anywhere from ₹ 5,000 up to your entire approved limit at one time. PaySense also offers an EMI calculator through which you can check how much you will be paying every month.

Dhani

Dhani popularly marketed as phone se loan app, instantly disburses the loan amount to your bank account. You can apply for a personal loan anytime, anywhere. You can get a loan of up to ₹ 15 Lakh instantly at an interest rate starting at 12%. You can download the Dhani loan app for free, enter your Adhaar card number, your loan amount, and get the loan amount in your account instantly.

India Lends

IndiaLends is one of the cash loan apps in India for instant personal loans, credit cards, and free credit reports.IndiaLends offers instant personal loans online with the best interest rate and disburses the loan within 48-hours. IndiaLends’ instant loan app in India extensively makes use of data and technology to improve workflows and risk assessments so that the loan disbursal process is efficient, shorter and easier.

KreditBee

KreditBee is an instant personal loan app for young professionals. You can get a loan of up to ₹ 1 Lakh. The loan process is 100% online. The disbursement is done within 15 mins, and the amount is directly credited to your bank account.

NIRA

NIRA is a FinTech company that offers a line of credit to salaried professionals in India. The personal loan offered to you is in the form of a line of credit, which has a credit limit range starting from ₹ 3,000 to ₹ 1 Lakh. The loan tenure ranges from 3 months to 1 year. You can withdraw a minimum of ₹ 5,000 each time. The interest applied to the loan amount depends on how much you borrow and when you repay the borrowed amount.

CASHe

CASHe is an app-based digital lending platform that provides short-term personal loans for various financial needs, but only to salaried individuals. You need to provide documents such as salary slips, bank statements, address proof, and PAN card, which can all be uploaded through the cash loan app while applying for a loan. Capital you can also check loan eligibility and interest rates online, using a quick calculator. The approved loan amount can range from ₹ 5,000 to ₹ 2 Lakh, with tenures ranging from 15 days to 6 months. Repayments can be made through a bank transfer or cheque deposit every month.

Capital First Limited

Capital First’s instant loan app in India is a one-stop solution for most of your financing needs. Your online loan application is sanctioned within 2 minutes. The company provides flexible repayment tenure of 1 to 5 years for a loan amount ranging from ₹ 1 Lakh to ₹ 25 Lakh. If you are an existing customer, you can easily access your loan account details, statement details and raise service requests. You can also check your outstanding balance and your payment dates.

Credy Technologies

Credy is one of the quick loan giving apps in India that provides personal loans on personalised terms. With no hidden costs, no requirement of collateral or a guarantor, fast online processing, and acceptance of a low CIBIL score, Credy is simple, fast and low-cost. The company provides loan durations ranging from 3 to 15 months for amounts between ₹ 10,000 to ₹ 1 Lakh. The rates of interest start at 12%, annualised. You can utiliseCredy for quick cash loans, enhancing lifestyle, refinancing loans and credit card bills, and for financing education- either for yourself or your children.

Money View

With Money View personal loan app, you can get a personal loan in just 2 hours. Whether you want to remodel your home, buy an expensive ride or cover your wedding expenses, a personal loan from Money View is completely paperless, fast, easy and flexible. Money View loan amount ranges from ₹ 10,000 to ₹ 5 Lakh. The repayment period is flexible and ranges from 3 months to 5 years.

Early Salary

EarlySalary, a FinTech startup in Pune has been creating ripples in the way money lending happens in India. Its personal loan app allows an easy and fast way to get instant loans. The loan amount limit is up to ₹ 2 Lakh at an interest rate starting from 2% per month.

SmartCoin

SmartCoin is a FinTech company with a mission to offer its HomeCredit1 customers a user-friendly and scalable lending platform. It is a personal loan app in India that provides instant loan for individuals looking for short-term personal loans. Use its mini loan app to get loans from ₹ 1,000 to ₹ 25,000. The company caters to all profiles like support executives, business owners, salaried professionals, managers, stay-at-home moms, teachers and more with no minimum limit on the salaries, unlike other personal loan apps.

Home Credit

Home Credit India is a part of the international Home Credit Group that has a presence across ten countries in Europe and Asia. The India chapter started in 2012 and it already has operations in over 60 cities across 15 states. The personal loan app sanctions personal loan of up to ₹2 Lakh with a repayment tenure ranging from 9 months to 4 years. The instant loan app in India makes financial services simple, transparent and easily accessible to you.

LazyPay

LazyPay is powered by PayU. You just need to enter your mobile number to find out your personal loan eligibility. With quick approvals and safe online loan application processing, LazyPay disburses 1 million+ loans every month. Its key offerings include pocket-friendly EMIs, an instant personal of up to ₹ 1 Lakh through an easy digital process with minimal documentation.

AnyTime Loans

AnyTimeLoan (ATL) offers on-demand, instant, 24×7 loans to salaried individuals and self-employed professionals. The loan process through its personal loan app is 100% paperless, contactless and frictionless. ATL offers unsecured personal loans in India, K12 education loans, business loans, etc., in a minute with no physical documents, collateral or guarantor.

mPokket

mPokketis an instant loan app in India for college students. It works on the concept of pocket money for students. Once your personal loan application is approved the personal loan amount is sent to your bank account or your Paytm wallet. The initial amount approved is ₹ 500 and your borrowing limit will increase over time with good usage. You can repay your loan within 1 to 3 months.

Flexsalary

This company has planned its product to take on personal loans. Thus, its features are in sharp contrast to those of personal loans. One-time application, one-time approval, instant disbursals, the option to access the credit anytime, the option to decide the loan tenure, and a flexible repayment policy are a few hallmarks of Flexsalary. The company has no fixed EMIs and provides instant approval, making it function as an advance salary loan app.

Bajaj Finserv

Bajaj Finserv offers personal loans that are instantly approved and disbursed within just 24 hours. These collateral-free loans are offered to women, government and public sector unit (PSU) employees, schoolteachers, college professors and more. The personal loans are offered with a feature to reduce your instalment by up to 45% by paying interest-only EMIs. Once approved, you borrow as much as you need from your approved loan amount without the hassle of reapplying for the loan.

Rupeelend

Rupeelend, launched in 2015 is a digital finance company that offers short-term credit to individuals and businesses. Currently, it operates in Bangalore, Mumbai and NCR. The personal loan online application process takes just 3 minutes with a promise of quick loan decisions. Rupeelend is a secure and trustworthy personal loan app for short term emergencies.

PayMeIndia

PayMeIndia is an innovative FinTech app that offers instant payday loans, advance salary loans,short term cash loans to salaried employees at attractive interest rates. These cash loans are designed to cater all your short-term financial needs that include a medical emergency, purchasing a big-ticket item, financing a wedding, and many more. The traditional and modern lending techniques are blended with technology to make the loan application process quick and simple. The cash loans are offered with convenient and flexible repayment plans.

LoanTap

LoanTap is an online platform that delivers instant, flexible loans on attractive loan terms to salaried professionals and businessmen. This fintech lending platform is committed to deliver customised loan products to millennials in an otherwise cluttered and dull personal loan segment. LoanTap offers a variety of innovative products such as personal loans, personal overdraft, EMI free loans, credit card takeover loans, rental security deposit loans, advance salary loans, and house owner loans.

RupeeRedee

Incepted in 2018, RupeeRedee is a digital lending platform that allows consumers to fulfill their lending needs in simple steps with the help of technology. The app gives you access to personal loans within a few minutes at your fingertips. It is a tech-driven digital lending platform that leverages technology and data sciences to make lending accessible for India’s massive population of underserved customers. With robust KYC and a smooth process, it makes the consumer journey hassle-free, quick and also safeguards your data. It currently has 4.51 million installs on Google Play Store and has an average traffic of 400K on its website. Operating with its own Captive NBFC FincFriends Private Limited in the background to facilitate short-term personal loans coupled with digital lending services and have deployed various forms of underwriting including alternate data sources and is not restricted to credit score-based underwriting only.