-

Aadhaar Card

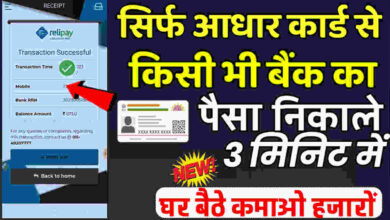

Aadhaar Card Bank Balance Kaise Check Kare 2024 : AEPS ID FREE

Aadhaar Card Bank Balance Kaise Check Kare : भारत में AEPS का मतलब “आधार सक्षम भुगतान प्रणाली” है। यह एक ऐसी प्रणाली है जो आधार…

Read More » -

Online Earning

Tringa Colour Trading: A Unique Online Trading Platform

In the world of digital trading, Tringa Colour Trading has emerged as a dynamic and engaging platform. With a user-friendly interface and exciting trading opportunities,…

Read More » -

Online Earning

51 Club: The Premier Online Gaming Destination

In the fast-growing world of online gaming, 51 Club has emerged as a top-tier platform for players seeking excitement and rewards. With a user-friendly interface…

Read More » -

Online Earning

Tpplayy: The Ultimate Online Gaming Platform

In the ever-expanding world of online gaming, Tpplayy has emerged as a leading platform offering an immersive and exciting gaming experience. With a user-friendly interface…

Read More » -

Online Earning

BHT Club: The Ultimate Color Trading Platform

In the ever-evolving world of online trading, BHT Club has emerged as an innovative and exciting platform for color trading. With its user-friendly interface and…

Read More » -

Online Earning

colour prediction chart pdf free download : Colour Trading Secret PDF

Understanding colour trends can be essential in fields such as design, marketing, and trading. A Colour Prediction Chart provides a visual representation of colour patterns,…

Read More »