Get Zero Balance Account IndusInd Bank Savings Account : Apply Now

Who can open Indus Online Savings Account ?

- Individuals residing in India

- Indian citizens

- Individuals above 18 years of age

- Aadhaar Card holder

- PAN holder

Indus Online Account : Premium Debit Card

- Minimum average balance is waived off.

- You get a Platinum Plus Debit Card that comes with a host of features.

- Freedom to choose the account number of your choice.

- Secure your Indus Mobile App by your fingerprint.

- Get all balance and transaction alerts on Whatsapp. Click here to know how to start Whatsapp Banking.

- You can book your cab, order food from your Indus Mobile

- Withdraw cash with no charges and deposit cash up to Rs.2 Lakhs with no charges.

- Movie goers are in for a treat. You can receive up to 12 free movie tickets per year on BookMyShow. You get one ticket when you buy one.

- You can save up to Rs. 250 per month on fuel surcharge waiver.

- The savings account comes with a higher ATM Limit of Rs. 1.25 lakhs per day and daily POS limit is Rs. 2.5 lakhs.

Indusind Bank Savings Account Interest Rate :

- Interest rate for Daily Balance up to Rs.10 lakh: 4% p.a.

- Interest rate for daily balance above Rs.10 lakh and up to Rs.1 crore: 5% p.a.

- Interest rate for daily balance above Rs.1 crore: 6% p.a.

Get Zero Balance Account IndusInd Bank Savings Account

Indusind Bank में Zero Balance Account कैसे खोले ?

क्या आप भी Indusind Bank में एक जीरो बैलेंस अकाउंट खोलना चाहते है और आपको नहीं पता है की कैसे Indusind Bank Zero Balance Account खोले। तो आप बिल्कुल ठीक जगह पर आए है। आपको इस आर्टिकल को ध्यान से पढ़ना है।

Indusind Bank Zero Balance Account खोलने की सुविधा देता है जिससे उसके ग्राहकों को अपने खाते में मिनिमम बैलेंस मेन्टेन करने की जरूरत न पड़े। तो अगर आप भी इंडसइंड बैंक में जीरो बैलेंस अकाउंट खुलवाना चाहते है तो इस आर्टिकल कि अब तक बने रहे. इस आर्टिकल में मैं आपको स्टेप बाए स्टेप पूरी प्रक्रिया बताऊंगा की कैसे Indusind Bank Zero Balance Account खोले। अगर आपको अकाउंट खोलने में किसी भी तरह की कोई दिक्कत आ रही हो तो आप हमे अपनी दिक्कत बता सकते है।

Mobile Banking Activation Process :

1. सबसे पहले IndusMobile App को Install करे

2. App Open करने के बाद मोबाइल नंबर डालकर Enter करे

3. अब User ID डालकर login करना है

4. फिर Set किया हुआ MPIN डालेंगे

5. उसके बाद OTP से Verify करेंगे

6. अब कुछ Questions का Answer देकर आगे बढ़ जाये

7. जिसके बाद आपके सामने Account Dashboard होगा

Also Read : Axis Bank IOCL Credit Card

Type Of Indusind Bank Bank Account 2023 : Indus Delite: Open Instant Zero Balance Savings Account Online

| Indus Exclusive Savings A/C |

| Privilege Savings Account |

| Maxima Savings Account |

| Classic Savings Account |

| Senior Savings Account |

| Select Savings Account |

| Diva Savings Account |

| Easy Savings Account |

| Indus Young Saver |

| Privilege Active |

| Small Account |

| Indus 3-in-1 |

FAQs : Get Zero Balance Account IndusInd Bank Savings Account

- What is the difference between saving and a digital saving account ?

A digital savings account differs from a regular savings account in terms of the convenience it offers when opening an account. To open a regular savings account, you have to visit your nearest branch to fill in the application and get started.

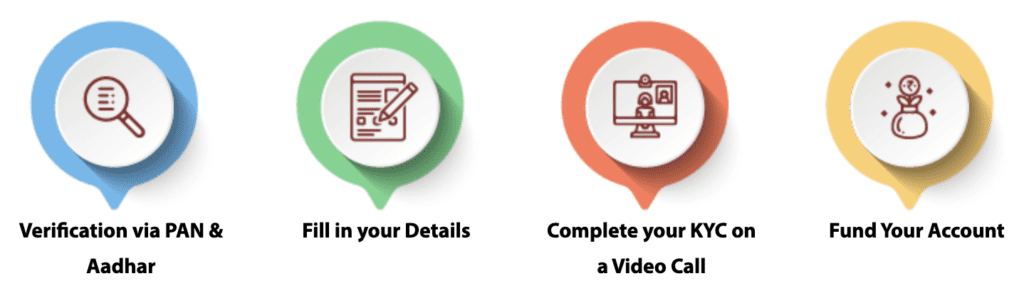

- How do I apply for a digital savings account?

You can apply for a digital savings bank account online. Follow a 100% secure and paperless application process – enter your details, submit your PAN and Aadhar card details and complete the KYC process on a video call. Open an online digital savings account to save and manage your funds at an attractive interest rate.

- What interest rates does IndusInd Bank offer on Digital Savings Accounts ?

Indus Digi Start, our zero balance digital savings account, offers you attractive interest rates on your savings!

- How do I transfer funds using my Digital Savings Account ?

Digital savings account with zero balance offer you easy access to all the banking services such as online transfers, withdrawals, remittances, and more.

With a digital savings account, you can transfer funds through internet banking services, Indus mobile banking app, or through UPI via other payment apps. The ease of managing and transacting funds online is what makes opening digital savings account a convenient choice.