Nira App Se Loan Kaise Le : Nira Loan Apply Online

Nira is one of the newest money lending apps in India. With this app, you can take an instant loan of up to Rs.1,00,000. There is no need to have a good credit score to avail the loan, nor will you have to visit banks. Now you can take loan in a jiffy from your phone sitting at home. If you are thinking of taking an instant loan then Nira Loan App is the best. Here in just 3 minutes you can find out whether you are eligible for the loan or not. In today’s post, we will give you every information related to Neera app, how much loan can be taken from Neera app? What documents will be required to take a loan from here and what is the Eligibility Criteria for taking a loan from the Neera app?

Procedure to take loan from Nira App :

To take a loan from the Neera app, we will tell you some steps, which you can follow one by one and take a loan from the Neera app very easily, so let us tell you all the steps one by one –

- First of all you have to download Neera app in your mobile and install it.

- Now open this app and choose your language inside it and then fill all the information and sign up

- After this select the amount of loan you want and then select the tenure means for how many months you want this loan

- Then calculate EMI and click on process button

- As soon as you press the process button, you will be asked some questions and you should read them carefully and then apply for the loan.

- After this Neera app will ask you for some permissions and all of you have to allow them and this permission will be camera, location and contact, apart from these you may have to give some other permissions as well.

- And as soon as you give all the permissions, then you will get a box named Privacy Policy below, you have to click on it and click on OK below.

- After this you will get the option to enter your mobile number where you have to enter the same number which is linked to your Aadhaar card.

- And as soon as you enter your mobile number, after that an OTP will come on your mobile number, you have to enter it in this app and then click on register.

- Then you will be asked all your personal information and you have to fill all the information correctly, if you fill any wrong information then you will have trouble getting the loan and we tell you what information you have to fill.

- A year ago you will be asked what work you do and in this you will be asked whether you work yourself or work on salary basis.

- Then you will be asked how you get the money, cash or bank account

- And you will be asked how much money you earn every month

- After this you have to tell your full name which is written in Aadhaar card

- Your date of birth as mentioned in Aadhaar card

- Your email id and phone number

- Pin code of where you live

- After this your experience will also be asked which you work and with this the name of the shop or company where you work will also be asked.

- Then your Gender will be asked and whether you are married with it or not will also be asked.

- You also have to tell whether your mobile number is linked with Aadhaar card or not.

- After this, you will also have to tell whether you are not already running any loan.

- And you also have to tell why you want to take this loan and how much loan you want to take

- And as soon as you fill all these personal information, then after that you have to scroll down and there you will find a button named Processed, click on it.

- And if you are selected by the company and you are eligible for the loan, then after filling all the information, you have to fill all the necessary documents as well and we will tell you which documents they will be.

- Your Aadhaar Card

- Your PAN card

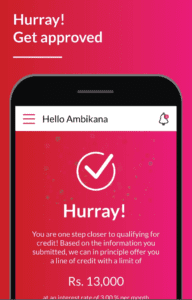

With this you will have to give your salary receipt or your bank statement for the last 3 months You also have to provide your selfie, And after this, as soon as you fill all these documents, after that you have to complete kyc and as soon as you complete kyc, the loan money will come to your account within 24 hours. And if you are selected through neera app or your documents are not selected then you will not get loan but you don’t have to worry because you can take loan from this app again after 2 months.

Also Read : Kreditbee Se Loan Kaise Le

Nira Loan App Benefits : Benefits of Nira Loan App

- Nira is an Indian Fintech organization that gives loans in almost all cities of India.

- You can avail personal loan from 5000 to 100,000 here

- You get 3 to 24 months to pay with Nira

- Loan can be taken from Nira Loan App in just less than 3 minutes

- You can take loan online from phone without ITR, security or guarantee

- To take a loan from the Nira Loan App, no pre-payment of any kind will have to be made before the loan

- Loan can be availed instantly without any physical verification

- If you have never taken a loan before, your CIBIL is 681, still you can take an instant personal loan from nira

- Whether you are in any job profession, whether you are a woman or a man, you can take a loan only by doing KYC in case of sudden need.

- Nira Personal Loan is 100% digital loan with no paper work required

- Your credit score (CIBIL) increases by making timely payments, so that you will not have trouble getting loans anywhere

Nira Personal Loan Eligibility Criteria :

- Applicant must be an Indian citizen.

- Applicant’s age (Age) 21 to 55 years.

- You must have at least 6 months of work experience.

- Your minimum monthly income is Rs. Must be 12000.

- You must have a degree from an educational institution.

- CIBIL Score 650 or above.

- You must have an Aadhaar card with you to complete the KYC verification process.

Documents:

- PAN Card

- Proof of address

- Source of income

- Details of your bank account

What are the features of NIRA App Loan :

- You can apply for the loan from the comfort of your home using the NIRA App.

- NIRA App is completely online process, you do not need any paper.

- If you are eligible for a loan on NIRA App, the loan will be transferred to your account within 24 hours of applying.

- There are no hidden charges on NIRA App Loan, whatever charges are openly mentioned in the application.

- If your monthly income is 12 thousand and you have work experience of 6 months then you do not need CIBIL score.

- You can apply for a loan on the NIRA App from anywhere in India.

- You do not need any guarantor or collateral to avail loan from NIRA App.

- You get the loan after completing KYC on NIRA App.

Nira Loan App Eligibility :

- age 22 to 58

- Must be an Indian citizen

- Should have a source of monthly income which is at least around 12,000

- Aadhaar linked mobile number will be required

- Internet banking with savings account will be required

- Nira Loan App must be served in your city

- You may also need to provide NACH approval for Nira Loan so that your Nira Loan is automatically disbursed from your account within the given time, for this you can use internet banking or debit card

Also Read : Student Credit Card Apply

- E-mail ID : [email protected]

- Website : https://nirafinance.com

Loan Types of NIRA Loan App : NIRA Loan App Types

- Instant Cash Loan – If there is a sudden need of money, then it is not possible to take a loan from the bank immediately. In such a situation, instant cash loan from ₹ 5,000 to ₹ 1,00,000 can be taken from the Instant Cash Loan of NIRA Loan App.

- Personal Loan – Your needs can be fulfilled by taking Personal Loan through NIRA Loan App for personal needs of any kind like education, marriage related expenses, medical expenses etc.

- Mobile EMI Loan – Through NIRA Loan App, you can take a loan to buy a mobile phone.

- Small Loan – Planning a holiday somewhere or gifting someone or paying coaching fees, you can take a loan of ₹ 5,000 to ₹ 1 lakh with NIRA Loan App Small Loan.

How to apply for NIRA Loan online :

- At first install NIRA App from Google Play Store.

- After this enter your phone number and verify with OTP, then click on continue button.

- After this select your language and click on OK button.

- After this fill the loan amount and select tenure and click on process button.

- After this, questions related to Neera loan will appear on your screen, read them and click on Apply Now button.

- After this fill your personal details like name, date or birth, gender, city, and click on Next.

- After this fill your business related information and bank details.

- After this upload the KYC documents like- Aadhaar Card, PAN Card etc.

- After doing this, your application will go for review, if you are eligible to take the loan, then your application will be approved, if not eligible, it will be rejected.

- After your application is approved, the loan amount will be transferred to your bank account.

- Till here the process is completed by NIRA Loan App Se Loan Kaise Le.

Fees and Charges on Nira App Loan :

You have to pay the following fees and charges :-

Processing Fees which can range from 1 to 4 percent of the total loan amount including GST.

You have to pay 2.5 percent Prepayment Fees.

Late Fees are charged at 2% of the outstanding amount if the overdues are more than 30 days and your bank may also levy a fee in case of bounce.

Nira Loan App Available Locations :

- Jaipur

- Lucknow

- Kanpur

- Nagpur

- Nndore

- Bhopal

Nira App Review :

If you ever suddenly need money, then you can definitely use Nira App, because here you get instant loan up to 1 lakh only on your KYC Documents,

But if you have Income Source then only you can take loan from Nira App, if you do not have any kind of income then you cannot get loan from this App,

Also, in the beginning you get less loan, as you pay, you will get bigger loan, take loan according to your need using your understanding.

How much interest is charged on Nira App loan (Rate of Interest) :

On Nira App you get Personal Loan with very low interest rates. The interest rate on Nira App is 2 to 3 percent per month.

For how long will the loan be available on Nira App (Tenure) :

If you take loan from Nira App then you get Repayment Period from 3 months to 24 months. You can repay your loan within this time. You can decide your tenure based on your loan amount and income.

FAQ’s :

Q1: How much loan can I avail from NIRA App?

With NIRA App, you can take a loan ranging from Rs 5,000 to Rs 1 lakh.

Q2: How long will it take to get the loan from NIRA App?

The loan amount is transferred to your account within 24 hours of applying for the loan from NIRA App.

Q3: Where can I access the NIRA App Loan?

You can access NIRA App Loan wherever you are.

Q4: When can the loan taken from NIRA app be repaid?

With the help of NIRA App, you can repay the loan anytime for 3-24 months.

Q5: How much is the processing fee and GST for taking loan from NIRA APP?

Friends, if we talk about how much processing fee and GST charge is levied on taking loan from NIRA APP, then friends 350 Processing + GST is levied. Meaning you can understand that processing fee ranging from 2% to 7% and GST is levied.

Q6: For how long can we take loan from NIRA APP?

Friends, if we talk about how long you can take a loan from NIRA APP, then friends from NIRA APP, you can take a loan from 91 days to 24 months. Whatever loan you take during this time will have to be returned.

Q7: How to take loan from NIRA APP?

Friends, if we talk about how you can apply loan from NIRA APP. If you can take a loan, first of all you have to download the official application of NIRA. You do not have to go anywhere to download. I give its link here. You will download NIRA APP by clicking on it. After that apply for the loan.