How to get personal loan without CIBIL score 2023

What is CIBIL Score ?

How to get personal loan without CIBIL score 2023 : CIBIL score is a 13 digit number, which can be found through PAN card. Due to the CIBIL score, any finance company, bank, mobile app etc. other online platforms are able to find out whether the applicant should be given a loan or not.

The better the CIBIL score, the more are your chances of getting the loan, because it tells that you are an honest person, and you will be able to deposit the loan on time, in such a situation, the bank will give loan to the beneficiary. Provides new offers.

Bina Cibil Score Ke Personal Loan Kaise Le: To take a personal loan without a CIBIL score, you can install loan applications such as Bajaj Finserv Home Credit, IFL, HDB, IDFC First Loan, etc. on the Google Play Store, etc. All these loans can be taken by installing The application provides loans only after checking the banking history of the applicant. With the help of these platforms, loans ranging from ₹ 3000 to ₹ 200000 can be taken.

How to take loan without cibil score, recently friends, there are many online mobile applications which provide you loan without cibil score, this mobile application approves loan only on the basis of your aadhaar card and pan card.

- Pan Card Se Loan Kaise Le

- Student Credit Card योजना 2023

- Ludo Game खेल कर पैसे कैसे कमाए

- Google Pay से Loan कैसे लें

- आधार कार्ड Bank Account Link Status Online कैसे चेक करें

Without CIBIL Score Instant Loan Eligibility

- Must be an Indian citizen

- age 21 to 59

- It is also necessary to have a source of monthly income so that at least 10,000 income is generated every month.

- Primary smartphone and internet will be required to apply

- Internet banking and debit card will also be required along with savings account.

- These loan apps must be served in your city

- Aadhaar linked mobile number will be required

Documents for Without CIBIL Score Instant Loan

- PAN card

- Aadhar card

- Can take selfie with loan app

- You have to esign the loan agreement through Aadhaar OTP

- NACH approval may also have to be given for which you will need internet banking or debit card

Personal loan app without CIBIL score

- Rapid Rupee (Loan Upto 60,000)

- Tala (Loan Upto Rs.10,000)

- Rufilo (Loan Upto Rs.25,000)

- Freepay (Credit Line Loan upto 10,000)

- Simpl Pay Later (Credit line loan upto 60,000)

- Loan Front (Loan upto 25,000 for salaried)

How to take personal loan without credit score

- Install the given loan app on your phone

- Signup with your Mobile Number or Social Account

- Now you have to do KYC, for this you have to give some important information like Personal and Job Info.

- Now you will get Eligible Loan Amount in Loan App

- To withdraw that loan, you have to enter your Saving Account Detail and activate NACH for Emi Auto Debit, which can be done through Aadhaar Otp.

- Your loan will be submitted as soon as you have accepted the loan agreement.

- You will get your loan in your account in no time.

- Pay your Emi on time and slowly your Cibil Score will start increasing slowly.

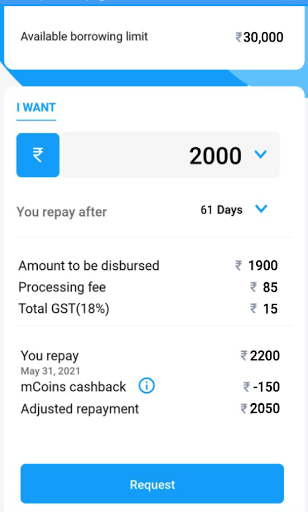

Fee and Charges on Personal Loan Without CIBIL Score

When you take Personal Loan Without Cibil Score by using any Loan App, then you get Unsecured Loan here and there is no security of money that it will come back, it gets expensive because there is a risk of drowning,

That’s why you may have to pay 18% to 36% interest annually, if you calculate the monthly interest then it will be 2 to 3% interest.

Along with this, the processing fee of the loan is also to be paid which is 2% and on top of that GST fee of 18% is also to be paid.

Along with this, if any of your Emi has become Late, then on top of that you also have to pay Late Fee, which depends on your Loan Amount.

Conclusion :

I hope today’s article has been helpful for you, where we have told you what is CIBIL Score (What is CIBIL Score ?) how to take loan without CIBIL score, etc. If you face any kind of problem then you can give your opinion in the comment box below. For more information, you can follow us on social media platforms.