Apply for Instant Personal Loan Online

Home Credit app is a finance and loan related platform from where you can take personal loan up to 5 lakhs, as well as on this app you also get the facility of online shopping from platforms like Flipkart and Amazon. EMI card facility is also available, you can take instant loan online in 5 minutes. Apart from personal loan, home appliance loan can also be taken. The entire process of taking a loan is online, so if you also need an instant loan, then apply online now. The owner of this app is Home Credit India Finance Private Limited which is operating from 10 April 2017.

Apply for Home Credit Personal Loan :

- First of all go to the official website of Home Credit.

- Enter your name and mobile number and click on ‘Apply Now’.

- Click on the ‘Want to Apply’ button on the next page.

- Now a form will open in front of you. Enter your name, email id and mobile number in this form and click on ‘Continue’.

- Once you complete the application process, a representative from Home Credit will get in touch with you with a number of plans.

- You can process your loan application by selecting the scheme as per your convenience.

- Finally as soon as your loan is approved, the loan amount will be disbursed to your bank account.

Documents required for availing Home Credit Personal Loan :

Check all the documents you need to apply for a Home Credit personal loan The documents required to avail a personal loan from Home Credit include:

- PAN Card (Form 60 if PAN card is not available along with one of the following documents – Passport, Voter ID and Driving License – for ID proof)

- Voter ID Card

- government accommodation allotment letter

- driving license

- Passport

- property tax receipt

Also Read : Money View Loan App

Home Credit Loan Fees and Charges :

- Processing Fee Nil

- Loan Registration Charges 450

- Penalty on late EMI payment

- Rs 350, one day after the due date

- Rs.800, 30 days after the due date

- Rs.1350 after 60 days of due date

- Rs.2100, ninety days after the due date

How to download Home Credit Personal Loan App ?

Home Credit provides loan app facility for mobile users which has many benefits, you can also apply for personal loan from this app as well as get many facilities related to personal loan.

Follow the steps mentioned below to download the Home Credit Personal Loan App: Follow the steps mentioned below to download the Home Credit Personal Loan App :

- Go to Google Play Store.

- Search “Home Credit Personal Loan App”.

- Here the Home Credit Official Loan App will appear in front of you, download (install) it.

- This is how you can download and install the Home Credit loan app.

Home Credit Personal Loan Eligibility :

If you are eligible for this loan then only you can apply for it. The eligibility to apply is as follows:

- The age of the applicant should be between 19 to 68 years.

- All types of salaried/self-employed/pensioners can apply for this loan.

- Bank Account Status : Active.

- You should have all the necessary documents like identity and address proof etc.

- Your CIBIL score should be very good.

Also Read : Loan Kaise Le

Why take a loan from Home Credit Loan only ?

Friends, now we will talk about why you should take a loan from Home Credit Loan and about the features offered by it.

- Any Indian individual interested in availing a loan from Home Credit Loan can apply.

- You do not need any guarantor or collateral to avail a home credit loan. You can also avail a home credit loan without collateral.

- While taking a loan, it is seen that the paperwork for the loan is huge. But with home credit loans, you do not have to go through long paperwork to avail the loan.

- You can use this loan for any kind of expenses that come in your daily life.

- After applying for the loan, if your application is accepted, the amount is transferred to your bank account within the next 5 working days.

- Home credit loan also does not charge a lot of money from its customers in the form of processing fees. It charges money from you as processing fee at 5% rates.

- The interest rates on the loan start from 24.9% which can go up to a maximum of 55%.

- You are also provided with a flexible tenure to repay the loan. In which you can easily repay the loan taken from home credit loan. For this, a period ranging from 9 months to a maximum of 51 months is made available to the customers.

- You are also provided with the option of top up on the loan taken from this app.

Home Credit Loan processing Fee & Charges :

When taking a loan from Home Credit, you have to pay different processing fees and charges for different loans. Given below are the processing fees and charges for all loans.

Mobile Phone on EMIs

- Processing fee – Up to ₹ 799

- Rate of Interest – Up to 30% P.A.

- Late Payment Charges – ₹ 350

- Down payment – 0% – 40%

Home Appliances on EMIs

- Processing fee – Up to ₹ 1179

- Rate of Interest – Up to 36% P.A.

- Late Payment Charges – ₹ 350

- Down payment – 0% – 40%

Two-Wheeler Loan

- Processing fee – 2.5% or Max 2500/-

- Rate of Interest – Starting 11.60%

- Late Payment Charges – ₹ 350

- Down payment – 20% – 25%

Home Credit Personal Loan

- Processing fee – 0 – 3%

- Rate of Interest – 24.0 % – 56.5 % P.A.

- Late Payment Charges – ₹ 350

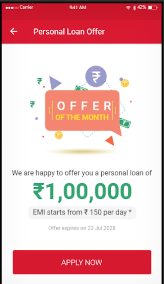

Home Credit Pre Approved Personal Loan Apply :

If you get a Home Credit Personal Loan offer, which itself offers home credit considering your old loan repayment behavior, then you will accept that offer.

Now the local executive of Home Credit will contact you for that loan, who will verify the KYC details given by you.

If your KYC details like your personal and professional details get verified, then your loan will be credited to your account in the next 24 hours after approval.

FAQ’s :

Q1. What is Home Credit Personal Loan?

The loan taken for the purpose of personal expenses is called personal loan.

Q2. How to avail Home Credit Personal Loan?

You must meet the Home Credit Personal Loan eligibility criteria to avail a personal loan from Home Credit. Once you meet the eligibility criteria, you can apply for a personal loan from Home Credit both online and offline.

Q3. Who can avail Home Credit Personal Loan?

Ans. Every citizen of India whose age is more than 19 years, and he is working in some work. Housewives, businessmen, small shopkeepers, self-employed persons, salaried persons, odd jobs, etc. can avail this loan from the nearest home credit store for home credit personal loan.

Q4. How to apply for Home Credit Personal Loan?

Ans. Home Credit personal loan can be deposited through HOME CREDIT APP, the official website of Home Credit, apart from this, you can deposit it on online payment apps like Google Pay, Phonepe, Paytm etc. by entering the loan number.

Q5. What is the interest rate on Home Credit Personal Loan?

Interest is charged at 2% per month on personal loan taken from Home Credit.

Q6. How to apply for Home Credit Instant Personal Loan?

Home Credit lets you apply for a personal loan both online and offline, both the processes are explained in this article.

Home Credit Helpline Number Below :

Email : [email protected].

Contact Number : You can call on 0124-662-8811. This is a toll free number that you can call on all days (Monday – Sunday) from 9:00 AM to 6:00 PM.