CASHe App Se Personal Loan Kaise Le : How to get loan from CASHe App

Through CASHe Instant Personal Loan, personal loans ranging from ₹ 9000 to ₹ 400000 are made available, for which minimum 90 days to maximum 540 days are given for payment, which is a very attractive interest rate ranging from 2.5% to 3% monthly. Provided at rate.

CASHe Instant Personal Loans are specially designed for young professionals to meet their urgent personal loan requirements. These loans are mainly given in the form of cash to meet the short term financial requirement. Terms like payday loan and advance loan are also used in the same context. You can apply for CASHe Instant Personal Loan online from Rs 9000 to Rs 4 lakh.

CASHe is an RBI and NBFC approved mobile application through which one can avail personal loans from ₹7,000 to ₹4,00,000. This mobile application provides instant personal loan in all cities of India in just 5 minutes but for this you need to have a good credit score.

And it is safe, fast, without paper work, self employed, job hunters, small shopkeepers can get loan through this.

This app has been launched in 2016. Its (Founder & CEO) is V.Raman Kumar. This app has arranged loans of more than Rs 2000 crores. This loan application has more than 3 lakh satisfied customers all over the world and it gives instant personal loan by approving the loan on minimum documents without any Salary Slip and without any Bank Statement. And it has been downloaded by more than 7 million people on the Google Play Store.

Also Read : Money View Loan App

What is the eligibility to take Quick Loan ?

- Must be a citizen of India.

- The age of the loan applicant should be more than 18 years.

- Must have Aadhaar Card and PAN Card.

- There should be a source of income so that the loan can be easily repaid.

- Must have a bank account number.

- Must have an account on Quick App.

- What are the features of Quick app loan ?

- The loan process is completely online, so you do not have to go anywhere.

- You can apply for this loan anytime 24/7

- There is less paperwork for this loan.

- In this you get a loan up to Rs.2,00,000

- In this you get time from 95 days to 365 days to repay the loan.

- In this, you can pay the loan in installments as per your convenience.

- In this you get loan at low interest.

- In this, you do not have to give any guarantor or security.

- Within no time of applying for the loan, the loan amount is transferred to your bank account, which you can use anywhere.

- It helps in improving your Cibil Score.

Document Required to take loan from CASHe App :

- If you want to take a loan from CASHe App, then for this you must have some important documents, only then you can get a loan from CASHe App.

- pan card

- A selfie photo

- ID Proof (Driving License/Voter ID/Passport/Aadhaar Card)

- Address Proof (Voter ID/Passport/Aadhaar Card/Driving License/Utility Bill)

- Bank statement of 3 months

- Aadhaar Card (Optional)

- What is CASHe Instant Personal Loan Eligibility Criteria?

- Must be a resident of India.

- Saving Bank Account.

- Your age should be between 23 years to 58 years.

How much loan can be taken from CASHe App (CASHe App Loan Limit) :

If you are thinking that how much loan you can get from CASHe App, then here for your information, let us tell you that CASHe is an Instant Personal Loan App. Who gives personal loans ranging from Rs 10,000 to Rs 3 lakh to Salaried Person and Self Employed people. Only a good credit score can get you this loan. If you are a resident of a metro city, the loan amount will be disbursed in your account with instant approval.

How to apply for loan from CASHe App ?

- Download the CASHe Personal Loan App on your smartphone.

- Now you have to login to your social media account or gmail account.

- Register yourself by entering your basic contact details like name, phone number, address and bank details.

- The next step is to enter your desired loan details ie: loan amount and tenure. You can avail a loan ranging from Rs 1,000 to Rs 4 lakh. The tenure can be up to 90, 180, 270, 365 and 540 days.

- You need to submit your recent and valid documents online to avail the quick loan.

- Once you upload all the details and documents, the app will review your request.

- Once your request is approved, the loan amount is transferred to your personal savings account.

Who can take CASHe Personal Loan :

CASHe who is more than 21 years of age and is a citizen of India and is employed in any work can take personal loan through digital process through Aadhaar card and PAN card. This loan is usually given to job professionals, small shopkeepers , Self Employed etc. people apply.

What is the Facility of CASHe Loan Application ?

Although there are many loan applications available in the market right now, which provide the facility of personal loan, but CASHe Loan App available on Google Play Store is the most special, this app is very popular in the market due to its specialty, which is due to the following features People are liking it very much.

- Get instant loan from CASHe App

- You can get the loan directly in the bank account.

- Loan is available on minimum documents.

- No security or guarantor is required.

- Time is saved in taking loan, there is no need to go round like banks.

- Loan is approved instantly.

- You can use the loan amount in the bank as per your convenience.

- The credit limit increases if the loan is deposited on time.

- Helps in increasing Credit Score.

- In this you do not need any bank statement and salary slip.

- In this, the loan amount can be filled in monthly EMI.

- You can shop online on No Cost EMI.

- Loan payment through Paytm, Phonepe, Amazon pay, google pay and net banking. Debit card .Can be done with credit card.

- With its help, you can also take Buy Now Pay Later loan.

CASHe App Customer Care Number :

Cashe App does not currently have any customer care number available, but for their support, you can ask your query on support by visiting Cashe’s official website or mail them- Cashe App Support Mail id- Support @cash.co.in

FAQ’s :

Q1: How much loan can be taken on CASHe App ?

If you have some important documents and your civil score is also fine, then you can easily take a loan of up to ₹ 4 lakh on CASHe App.

Q2: Can student get loan on CASHe App ?

If you are a student and you have to take a loan from CASHe App, then first of all you must be above 21 years of age and you must have documents for being a student and you must have an ID for income proof

Q3: When was CASHe App launched and who is its founder?

CASHe App is launched on 25 Feb 2016 and it is RBI approved loan application and it was founded by V. Raman Kumar ji and CASHe App also got good rating on google play store

Q4: Is CASHe App a secure loan application ?

Yes, CASHe App is a secure smartphone application approved with NBFC and RBI, so CASHe App is a secure application and you can apply for loan in this application, you can also check about it on mca.gov official website can do

Q5: How to take personal loan from Cashe App ?

If you want to take a loan from Cashe App, then we have given all the information about it in the article above, with the help of which you can easily take a loan and if you have taken all the information, then you can easily download Cashe App from Google Play Store. You can apply for loan from

Q6: Is CASHe Approved by RBI?

Yes, it is also approved by RBI.

Q7: Does CASHe Loan require CIBIL score?

Yes, one should have a good CIBIL score to avail a loan from CASHe.

Q8: What is the monthly income requirement for CASHe Loan?

To take a loan from CASHe, it is necessary to have a minimum monthly income of ₹ 12000.

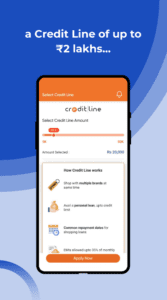

How to apply Cashe Credit Line Loan ?

- Install Cashe Loan Application on your phone

- Signup with your Social Account

- Upload KYC Details and Documents

- On the home page you will see Credit Line tap on it

- Set how much credit you want

- Setup NACH

- Accept Credit Line Agreement

- and submit loan application

- Within few hours if you are eligible you will get cashe credit line loan